2022 Australian Craft Beer Survey Results

2nd Mar 2023

The 2022 Australian Craft Beer Survey by Beer Cartel is the largest study of Australian craft beer drinking trends. It follows on from the 2016, 2017, 2018, 2019 and 2020 versions of the same study.

The 2022 survey received widespread support across the industry. In total over 14,000 Australian craft beer drinkers took part.

The survey was run between July-September 2022 and contained a range of questions relating to purchasing and consumption habits, and attitudes to craft beer.

The data that follows helps to provide a great picture of the growing Australian craft beer market.

A prize of $500 of craft beer was offered as an incentive to take part in the research. To see if you were the lucky winner scroll to the bottom.

Key findings from the research include:

1. Black Hops has been voted Australia's best craft brewery. For the second time Black Hops has been voted Australia's best, followed by Mountain Culture and Bentspoke Brewing.

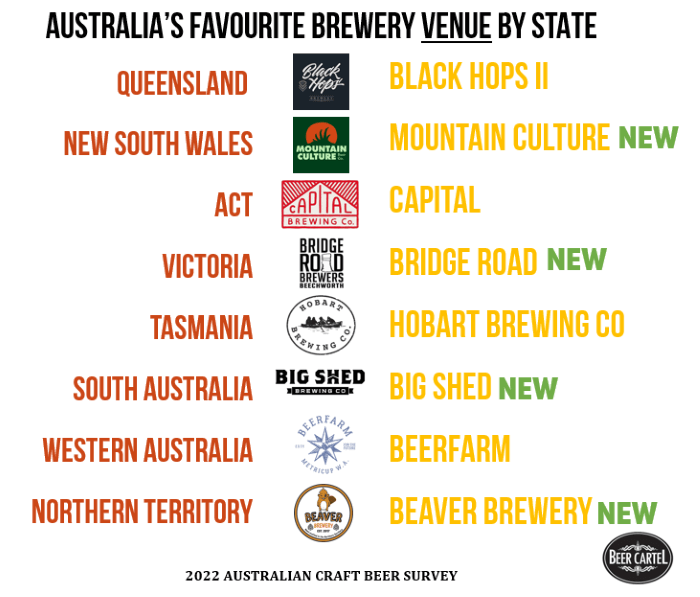

2. Australia's favourite brewery venue by state has changed for three states. Mountain Culture (NSW), Bridge Road (VIC) and Big Shed (SA) were new entrants to the number one position for best craft brewery venue in their respective state. Northern Territory venues were included for the first time in 2022, with Beaver Brewery voted the number one craft brewery venue in the territory.

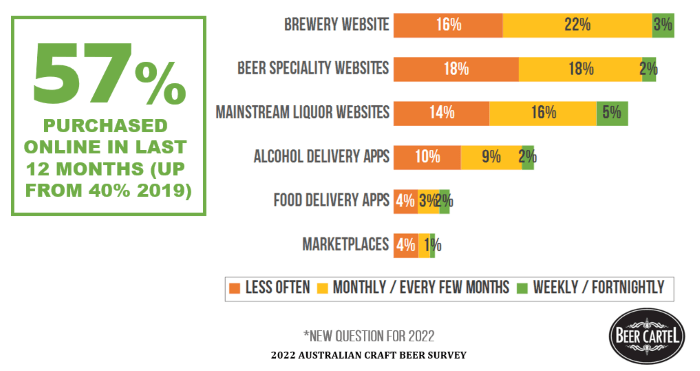

3. Online purchasing of craft beer remains high. 57% of respondents had purchased beer online in the last 12 months, up from 40% in 2019.

4. Alcohol-free continues to grow strongly as a segment. 32% have consumed an alcohol-free beer in the last 12 months, up from 15% in 2020.

5. Hazy / New England IPA's have increased significantly in the proportion consuming the style (78%), however Pale Ale remains the most widely consumed style (82%).

The Stats

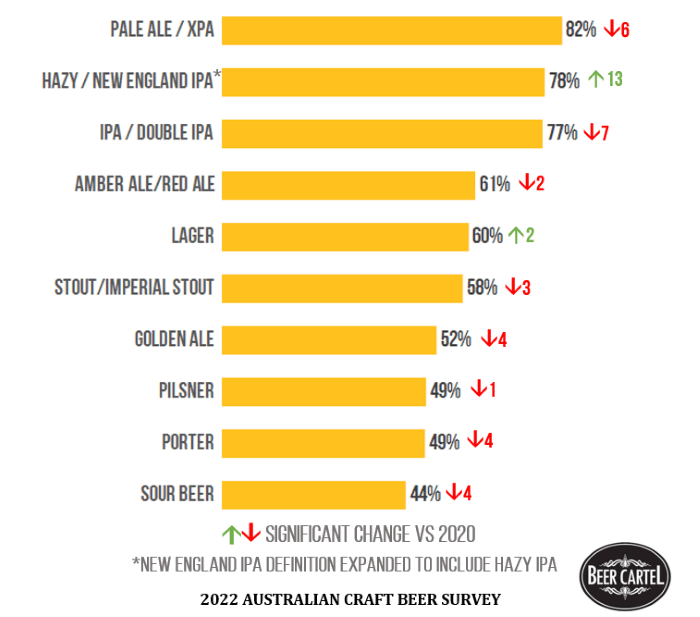

Australia's Most Consumed Beer Styles (Top 10)

There has been a reduction in consumption of most styles, with Hazy / New England IPA* and Lager the only two styles that increased in consumption.

Two styles have significantly fallen out of favour over the years, Golden Ale which dropped in percentage consumed from 70% in 2016 to 52% in 2022, and Wheat Beer which declined from 59% in 2016 to 42% in 2022 (not shown above).

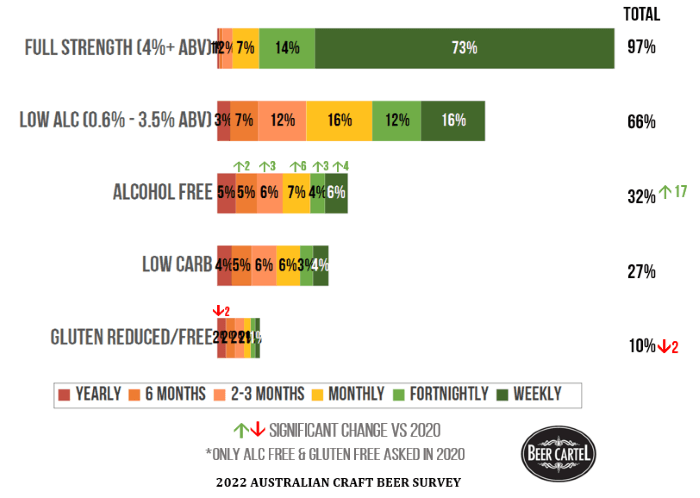

Consumption Frequency of Beer Categories*

The proportion of those consuming alcohol-free beer in the last year increased significantly in 2022 (32%), compared to 2020 (15%), with significant increases across all consumption frequencies (weekly - every 6 months), excluding yearly. Wherein 2020 just 3% were drinking alcohol-free weekly / fortnightly this has increased to 10%.

Full strength (4%+ alcohol) remains the most consumed category, with 87% drinking beers from this weekly / fortnightly.

While low alcohol beer (0.6% - 3.5% ABV) is consumed less regularly than full strength, two-thirds (66%) of beer drinkers consume this at least annually.

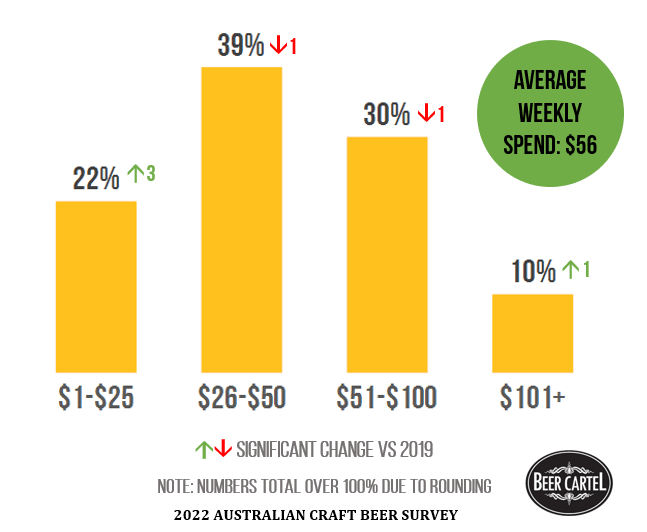

Weekly Spend on Beer

Average weekly expenditure on beer remains largely in line with previous years prior to Covid with average weekly spend remaining at $56.

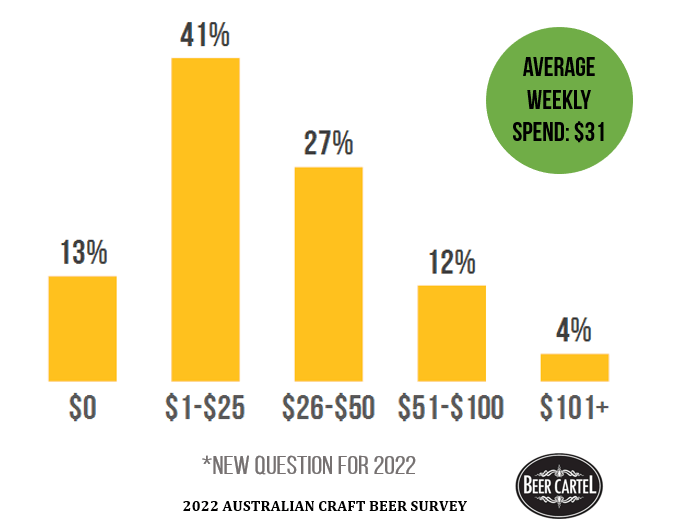

Weekly Spend on Other Alcohol*

Most (87%), also spend money on other alcohol products, although the average weekly spend is much lower ($31 vs $56). Note: lower average weekly spend on other alcohol expected given the target respondent was craft beer drinkers.

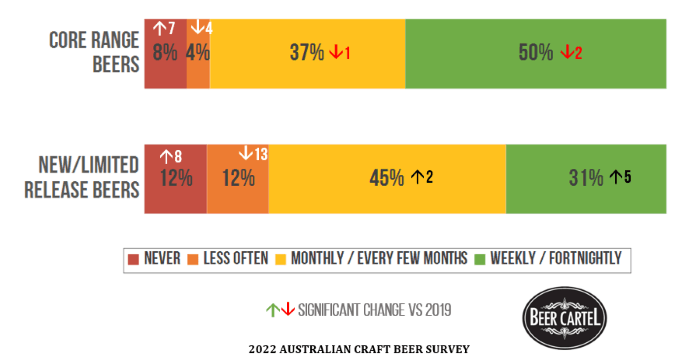

Purchase Frequency: Core Range vs New/Limited Beers

Compared to 2019 there has been an increase in those that frequently buy new/limited release beers. Core range beer purchase frequency in comparison has had minor declines across frequencies.

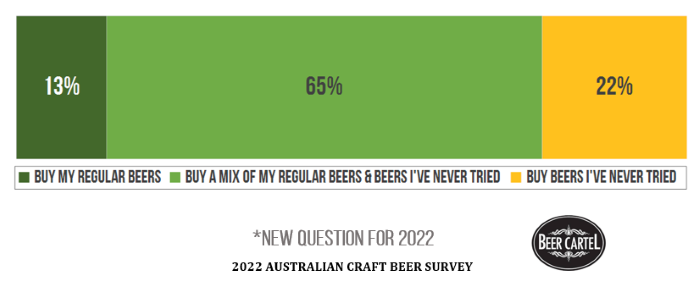

Main Purchase Behaviour: Core Range vs New / Limited Release Beers

The majority of beer drinkers buy a mix of beers they are familiar with and beers they've never tried. Only a small proportion almost exclusively buy beers they've never tried (22%) or beers they always buy (13%).

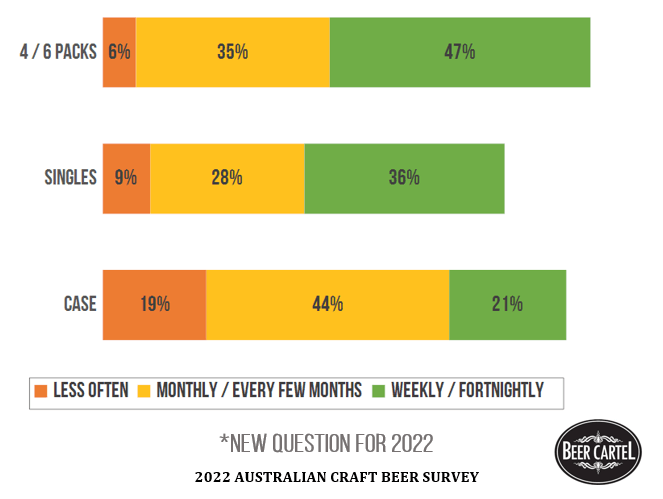

Purchase Frequency by Packaging Type

In terms of packaging format, 4/6 packs are the most regularly purchased.

Online Purchase Behaviour

Online purchasing of craft beer has grown strongly compared to 2019 with 57% purchasing beer online in the last 12 months, compared to 40% in 2019.

Brewery websites are the most used purchasing channel followed by specialty beer websites and mainstream liquor sites.

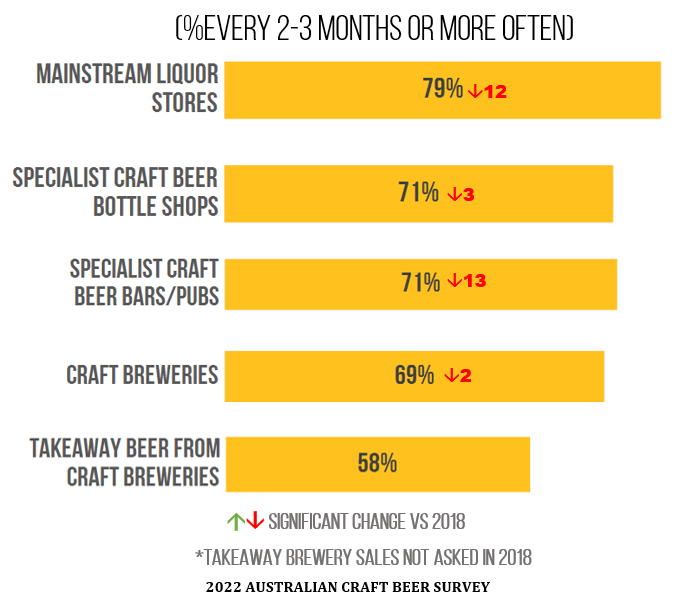

Craft Beer Visitation

While the proportion visiting specialist craft beer bottle shops and craft breweries every 2-3 months or more often has remained similar to 2018 (when last surveyed), the number of people going to mainstream liquor stores and visiting specialist craft beer bars/pubs has dropped by a large proportion (12% and 13% respectively).

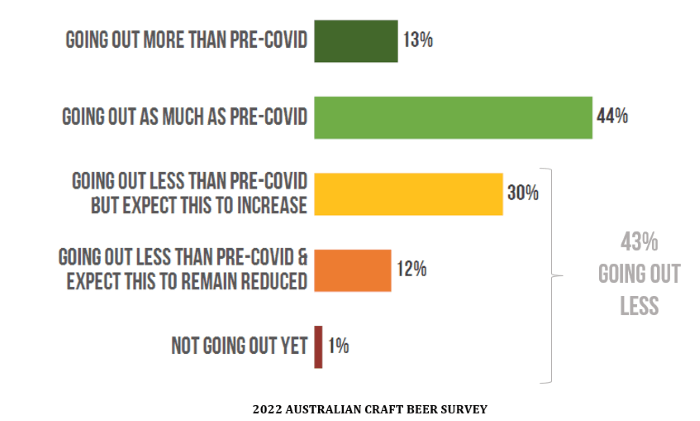

Attendance at Bars/Breweries and Beer Festivals (Compared to Pre-Covid)

While 13% state they are going out more compared to pre-Covid, 43% are going out less, relative to pre-Covid times.

Spotlight on Independence

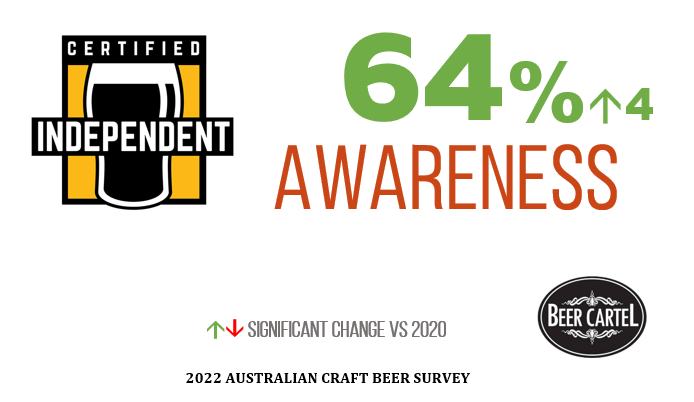

Awareness of Independent Brewers Association Independent Seal

Overall awareness of the Independent Seal from the Independent Brewers Association (IBA) continues to grow (now 64% compared to 60% in 2020, 41% in 2019 and 33% in 2018).

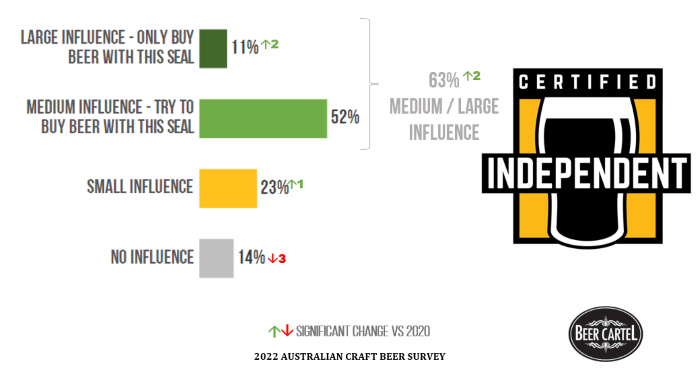

Impact of an Australian Independent Brewers Seal

Amongst those aware of the Independent Seal, more (63% vs 61% 2020) state that the seal has a medium/large influence on the beer they buy.

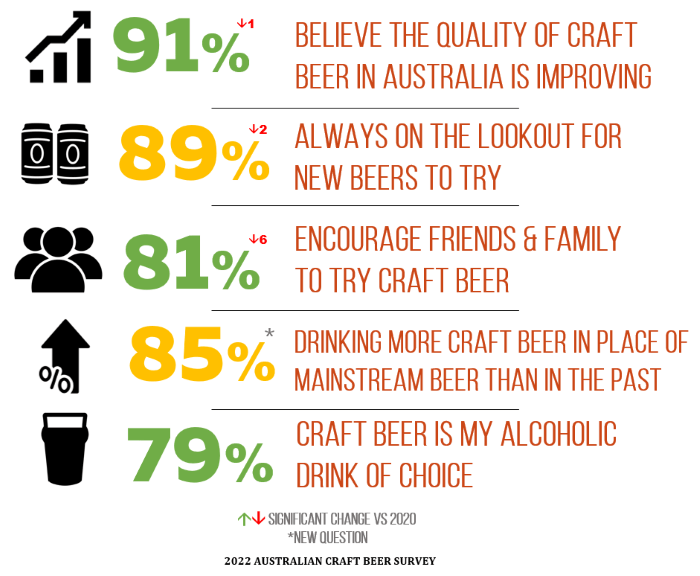

Attitudes to Craft Beer

The Awards

For the second occasion Black Hops has taken out the top spot for Australia's Best Craft Brewery, with recent GABS Hottest 100 winner, Mountain Culture, coming second. Bentspoke has maintained its position in third place, the same as 2020.

The Best Brewery Venue has seen three changes this year. Mountain Culture's Katoomba venue has replaced Wayward as New South Wales best brewery venue, Bridge Road has replaced Moon Dog in Victoria, and Big Shed has replaced Little Bang in South Australia. Northern Territory was added to the list for the first time in 2022 with Beaver Brewery the most liked brewery venue.

Amongst craft beer venues there has been no change in Best Craft Beer Bar / Pub for all states except Tasmania where The Winston tied top with St. John Craft Beer Bar.

The Grain Store in Newcastle and St. John Craft Beer Bar in Launceston are the only two venues which are located outside of the capital city in their state.

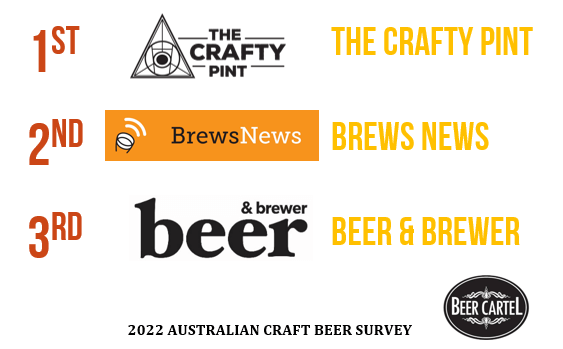

Australia’s Favourite Craft Beer News Website (By Readership/Usage)

The Crafty Pint continues to be Australia’s most read craft beer news site/blog and has done so every year since the survey began. Australian Brews News is second, followed closely by Beer & Brewer.

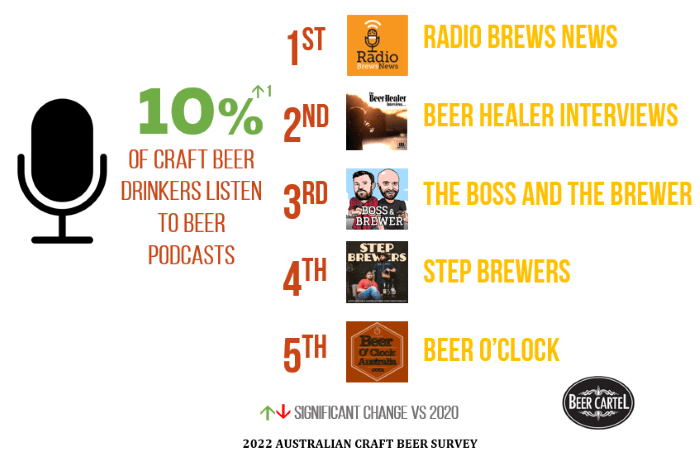

Australia’s Favourite Beer Podcast (By Usage)

10% of craft beer drinkers listen to podcasts, with Radio Brews News the most listened to podcast followed by Beer Healer Interviews.

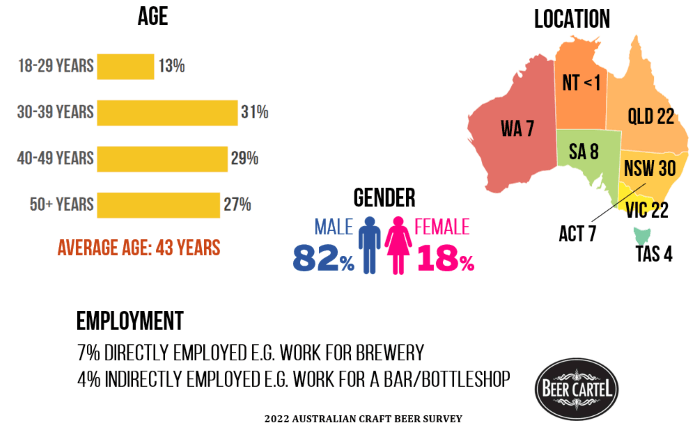

Australian Craft Beer Drinker Profile

Thanks

A special thanks goes out to all those who have helped support the 2022 Australian Craft Beer Survey. Without your assistance none of this would have been possible. We raise a glass to each and every one of you, and thank you for being a part of this hugely exciting industry!

Sharing of Content

Please feel free to share any of the information/charts above. We simply ask that Beer Cartel is attributed, including a link to www.beercartel.com.au when sharing online. High resolution images and interviews are available on request.

About Beer Cartel:

Beer Cartel is Australia’s leading online craft beer bottle shop, stocking over 1,000 craft beers from Australia and overseas. Purchases can be made through the Beer Cartel website www.beercartel.com.au.

Media Contact:

Richard Kelsey

Phone: 0405 251 864

Email: [email protected]

Website: www.beercartel.com.au

Winner of $500 of Craft Beer

Congratulations to A. Ryland winner of $500 to spend on craft beer.

Loading... Please wait...

Loading... Please wait...